Lobby group Okoa Uchumi warns 2025 budget will raise costs, deepen inequality in Kenya

Okoa Uchumi says several proposals in the Finance Bill 2025 place an unfair burden on ordinary citizens while protecting elite interests, risking greater inequality and undermining essential public services.

Fiscal watchdog Okoa Uchumi has sounded the alarm over Kenya’s 2025/26 budget, cautioning that unchecked expenditure and unfair tax proposals could sharply raise the cost of living, hitting food, education, and healthcare hardest for millions of Kenyans.

The lobby says several proposals in the Finance Bill 2025 place an unfair burden on ordinary citizens while protecting elite interests, risking greater inequality and undermining essential public services.

More To Read

- How to make sweet and savoury plantains at home

- Parliamentary Budget Office warns Sh2.2 trillion projects at risk over funding delays

- 2025 KCSE concludes smoothly as government reports sharp decline in exam cheating cases

- Businesses granted 30-day relief on long-stay container charges at Mombasa port

- Meta to deduct 5 per cent tax on Kenyan creators’ earnings in 2026

- National Treasury says weak revenue, high debt repayments straining Kenya’s budget

The proposed budget outlines Sh4.24 trillion in spending against projected revenues of Sh3.32 trillion, leaving a deficit of Sh876.1 billion. This gap is set to be covered largely through domestic borrowing, despite public debt already exceeding Sh11.35 trillion.

Address wastage

Okoa Uchumi criticised the government’s focus on expanding revenue collection while failing to address wastage, duplication, and poor spending priorities.

“Any measures implemented may not achieve the desired economic stability without addressing the underlying inefficiencies in expenditure,” the group warned.

One of the most controversial provisions in the Finance Bill is the proposed increase in the tax-exempt per diem allowance from Sh2,000 to Sh10,000, which Okoa Uchumi said would disproportionately benefit senior public officials.

“Workers in the informal sector, self-employed individuals, and low-income earners continue to face the brunt of taxation with minimal relief,” the lobby said.

The lobby also opposed the proposed repeal of Section 59A(1B) of the Tax Procedures Act, which currently protects citizens from surveillance by requiring the Kenya Revenue Authority (KRA) to obtain a court order before accessing personal data.

“If passed, this amendment would grant KRA unchecked surveillance powers… violating the constitutional right to privacy under Article 31,” it said, linking the move to fears stemming from the 2024 protests, which were marred by state surveillance and crackdowns.

Tax incentives

Okoa Uchumi raised concerns over proposed tax incentives for Special Economic Zones and the Nairobi International Financial Centre, arguing that without transparency, these could become tax shelters for politically connected individuals.

“These proposals represent a dangerous shift in fiscal fairness,” they said.

Another worrying change involves shifting essential goods like solar panels, animal feed inputs, electric vehicles, and raw materials for medicine from zero-rated to VAT-exempt status. Okoa Uchumi explained this would increase production costs and ultimately raise consumer prices, “placing the greatest burden on low-income households.”

Clean energy taxes

The group warned that taxing clean energy and medical inputs undermines Kenya’s health and climate goals.

The bill also seeks to scrap Section 17(5)(c) of the VAT Act, which allows businesses to offset excess input VAT against other tax obligations. Okoa Uchumi noted this would further squeeze small businesses that already suffer from delayed VAT refunds.

On budget allocations, the group expressed concern over continued prioritisation of the Public Administration and International Relations (PAIR) sector, which takes 11 per cent of the total budget, compared to six per cent for health and three per cent for social protection.

The group highlighted a Sh4.3 billion cut to free primary education, including a Sh600 million reduction to the school feeding programme, despite the number of targeted learners increasing from 2.6 to 2.8 million.

“Sh600 million could provide one meal a day for 50,000 children for the entire year,” the group noted.

Fertiliser subsidy

The fertiliser subsidy has also been slashed from Sh14 billion to Sh8 billion, even as the number of farmers targeted is set to double. Meanwhile, the government has created seven new state departments, including one for Justice and Human Rights, many of which were previously programmes under existing ministries.

“Are we cutting vital support to farmers just to finance more bureaucracy?” Okoa Uchumi posed.

While the group welcomed an additional Sh6 billion for the primary healthcare fund and Sh5 billion for emergency, chronic, and critical illness care, it criticised the lack of allocation to the Linda Mama maternity programme.

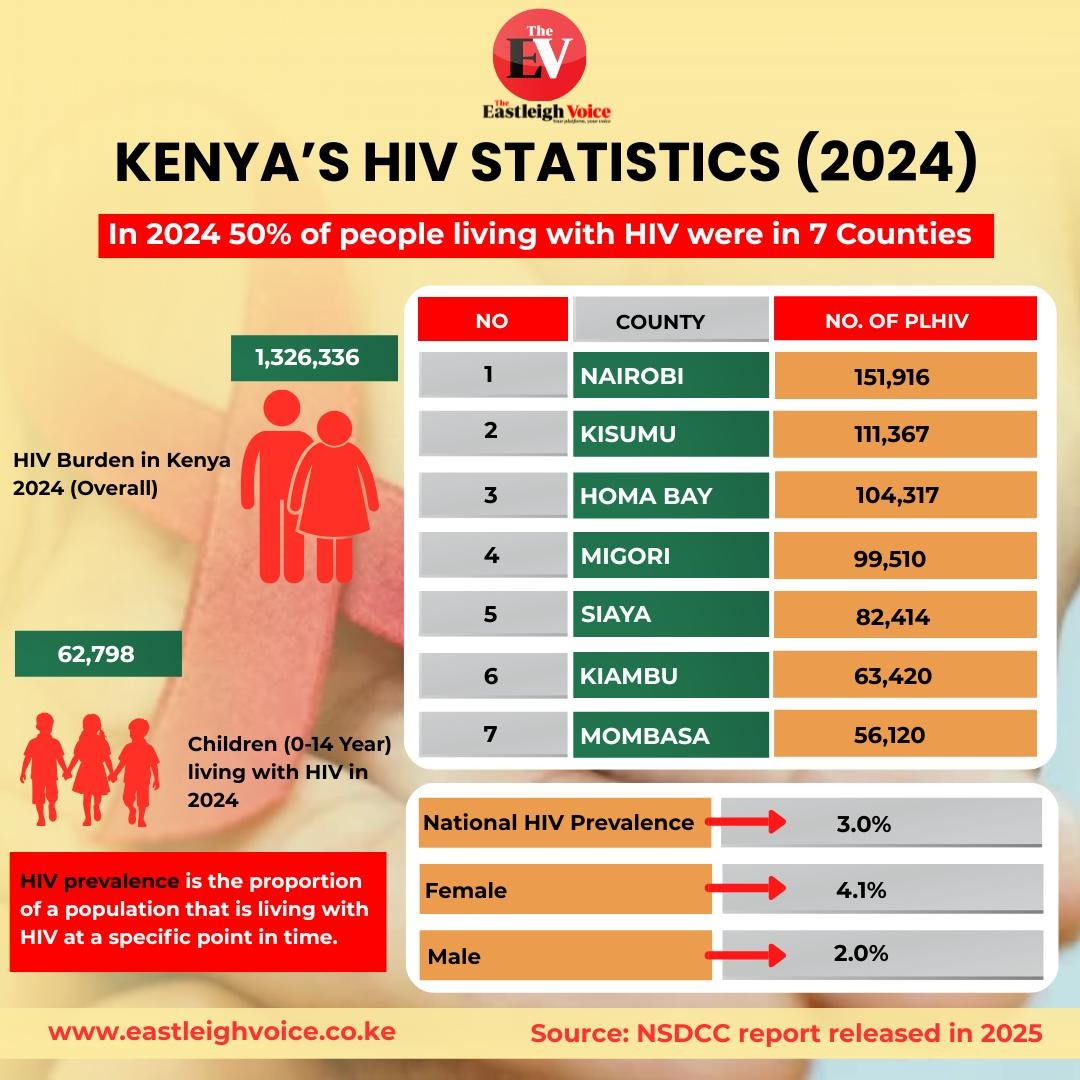

It also flagged no change in funding for the national AIDS control programme, despite a Sh9.4 billion funding gap after the US government’s stop-work order.

Increased spending on police

The watchdog condemned increased spending on police and security forces, warning of a tilt toward securitisation.

“The state is galvanising security forces that will unleash brutality,” they warned, citing previous threats and raids targeting activists.

They also criticised budget execution trends, noting how supplementary budgets often shift funds away from social services toward the Executive.

In the 2024/25 financial year, the budget for the Executive Office of the President rose by 17.6 per cent while funding for safety nets declined. Okoa Uchumi said such reallocations undermine public participation and violate the Public Finance Management Act.

The lobby urged Parliament to reject regressive proposals in the Finance Bill and refocus spending on essential sectors.

“Kenya cannot tax its way out of this crisis. Austerity for the poor and indulgence for the powerful is neither a viable path nor a sustainable alternative,” it said.

Top Stories Today